by

Badgley Phelps

| Mar 01, 2021

By Tim Thomas and Katie Wham

Last year’s outbreak of COVID-19 generated tremendous uncertainty in all aspects of our lives. In terms of financial markets, the volatility was extraordinary with wild swings in stock prices day to day and ultimately a sharp decline followed by

a dramatic rebound. In times like these it’s critically important to have a consistent process. Here are five tips for navigating uncertain financial times.

1. Do your homework

It’s important to do research on a wide range of investments, those poised for long-term growth, those that benefit when the economy is strong, some that are more conservative and pay interest or dividends, and others that hold up better in difficult

times. In times of uncertainty, the markets move quickly, and you won’t have time to start researching many new ideas. Instead, you want to have a bullpen of ideas at the ready so you can be nimble and act when the time is right.

2. Reassess opportunities

It’s also a good idea to use market volatility as a moment to reassess opportunities. From our perspective, this may mean taking advantage of price declines to purchase attractive long-term investments at a discount. Sometimes market volatility

can be a great time to take advantage of stocks on sale.

3. Don’t time the market

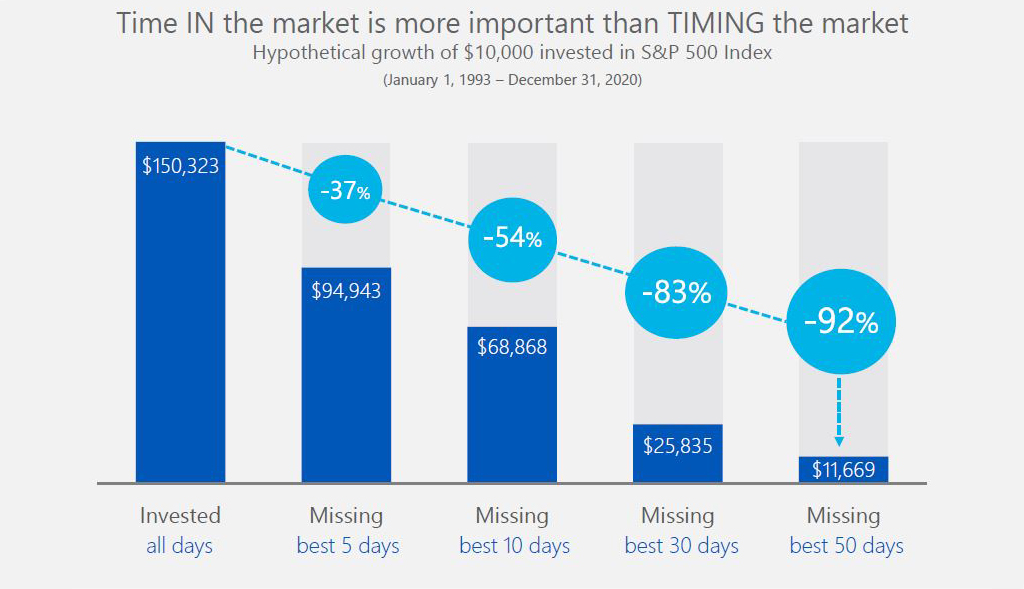

What matters is time in the markets, rather than trying to time the markets. If you invested $10,000 from 1993 through the end of 2020, that investment would have grown to more than $150,000.

Source: S&P 500 Total Return Index

Hypothetical ending values are calculated using the S&P 500 TR Index daily closing prices. “Missing” days are assigned a value of 0% when calculating hypothetical returns and ending balances.

The S&P 500 TR Index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in the index. Regular investing does not ensure a profit or protect against loss. Investors should consider their

willingness to keep investing when share prices are declining. This content, developed by Badgley Phelps Wealth Managers, is not intended to be used as a primary basis for investment decisions.

However, if an investor were to miss out on just the 5 best days over that time frame their gain would have been 37 percent less. Taking this further, an investor who missed the 50 best days would have generated a return that was more than 90 percent

less.

4. Diversify your portfolio

Diversification can help protect your

portfolio from unexpected zigs and zags in financial markets. Having a diversified portfolio reduces risk and smooths out some of the variability in returns between asset classes.

Source: The Bank of New York Mellon, Nareit

Large cap: S&P 500 TR Index, Small cap: Russell 2000, EM Equity: MSCI Emerging Markets Index, DM Equity: MSCI EAFE Index, Comdty: Bloomberg Commodity Index, Fixed Income: Bloomberg Barclays US Aggregate Index, REITs: NAREIT All Equity REIT

Index, Cash: Bloomberg Barclays 1-3m Treasury. The “Asset Allocation” portfolio assumes the following weights: 45% in the S&P 500, 5% in the Russell 2000, 7% in the MSCI EAFE, 3% in the MSCI Emerging Markets, and 45% in the Bloomberg

Barclays US Aggregate Balanced portfolio assumes quarterly rebalancing. Annualized (Ann.) return and volatility (Vol.) represents period of 12/31/05 – 12/31/20. All data represents total return for the stated period. The “Asset Allocation”

portfolio is for illustrative purposes only. Past performance is not indicative of future returns. Data as of December 31, 2020.

5. Focus on the long-term

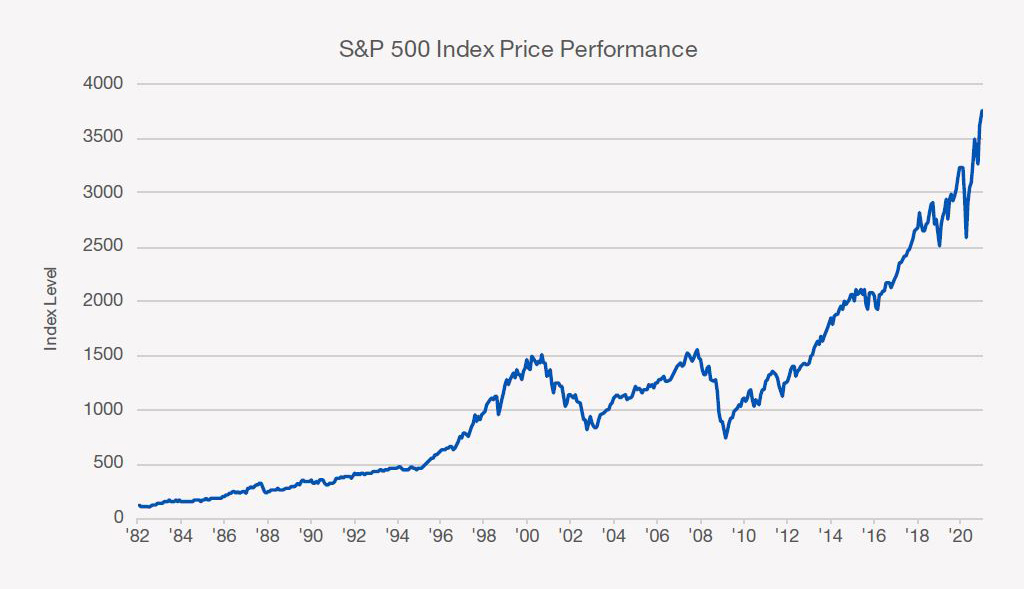

It’s important to focus on the long-term and avoid getting too pessimistic or optimistic at one point in time. The market has followed an upward trajectory over time, but there has been a lot of volatility along the way. As shown in the following

chart, from 1982 to the end of 2020, the stock market increased markedly, but there were significant corrections. The dot com bubble, the Great Recession of 2008, and last year’s global pandemic led to sharp declines in equity prices followed

by strong rebounds. To combat these swings in value, we suggest that you have a long-term plan and give the market time to work for you.

We hope you find these tips for navigating uncertain financial times helpful. Should you need help with financial planning or investment management, contact us.