by

Badgley Phelps

| Jul 13, 2016

What is it, why you should avoid it and how it’s like whipped cream

A familiar idiom warns against too much of a good thing, and concentrated stock making up a large portion of an investor’s portfolio, fits the bill. Here we’ll walk through the basics of concentrated stock—and why you should avoid it like that third dollop of whipped cream on your pie.

How much is too much?

Just like no one is going to police your pie-dolloping, there are no hard and fast rules that determine how much concentrated equity is too much. The acceptable amount will vary based upon the investor’s situation, their tolerance for risk and the degree to which a decline in the concentrated equity prevents them from achieving their goals.

How does a concentrated stock position happen?

According to FINRA, here are several common ways an investor might accumulate a concentrated stock position:

- Intentional concentration due to personal beliefs or decisions

- Concentration due to asset performance from a single investment outperforming the rest of the portfolio

- Company stock concentration

- Concentration due to correlated assets: Investments within the same industry, geographic region or security type tend to be highly correlated, meaning that what happens to one investment is likely to happen to the others.

- Concentration in liquid investments due to certain investments being difficult to sell quickly or imposing charges for selling before a certain timeframe

Concentrated equity positions may also result from the sale of a business or an inheritance. They are common among founders of successful companies, employees in the technology and biotech industries as well as long-tenured members of publicly traded companies.

Bitter risk versus sweet reward

Let’s face it: whipped cream is delicious. And the idea of generating tremendous wealth sounds good, too. Concentrated equity positions can present an opportunity to do just that. Consider that a 20 percent gain on a $3 million position is $600,000—and such profits are not uncommon in a single year during an equity bull market.

That said, while the opportunity to generate wealth is significant, a concentrated position is inherently risky because unforeseen changes at a company or with the economy can hit much harder than they do if a portfolio is diversified.

Thankfully, investors can take action and diversify many of these risks by reducing the size of the concentrated position and adding new assets to their portfolio.

Types of risk

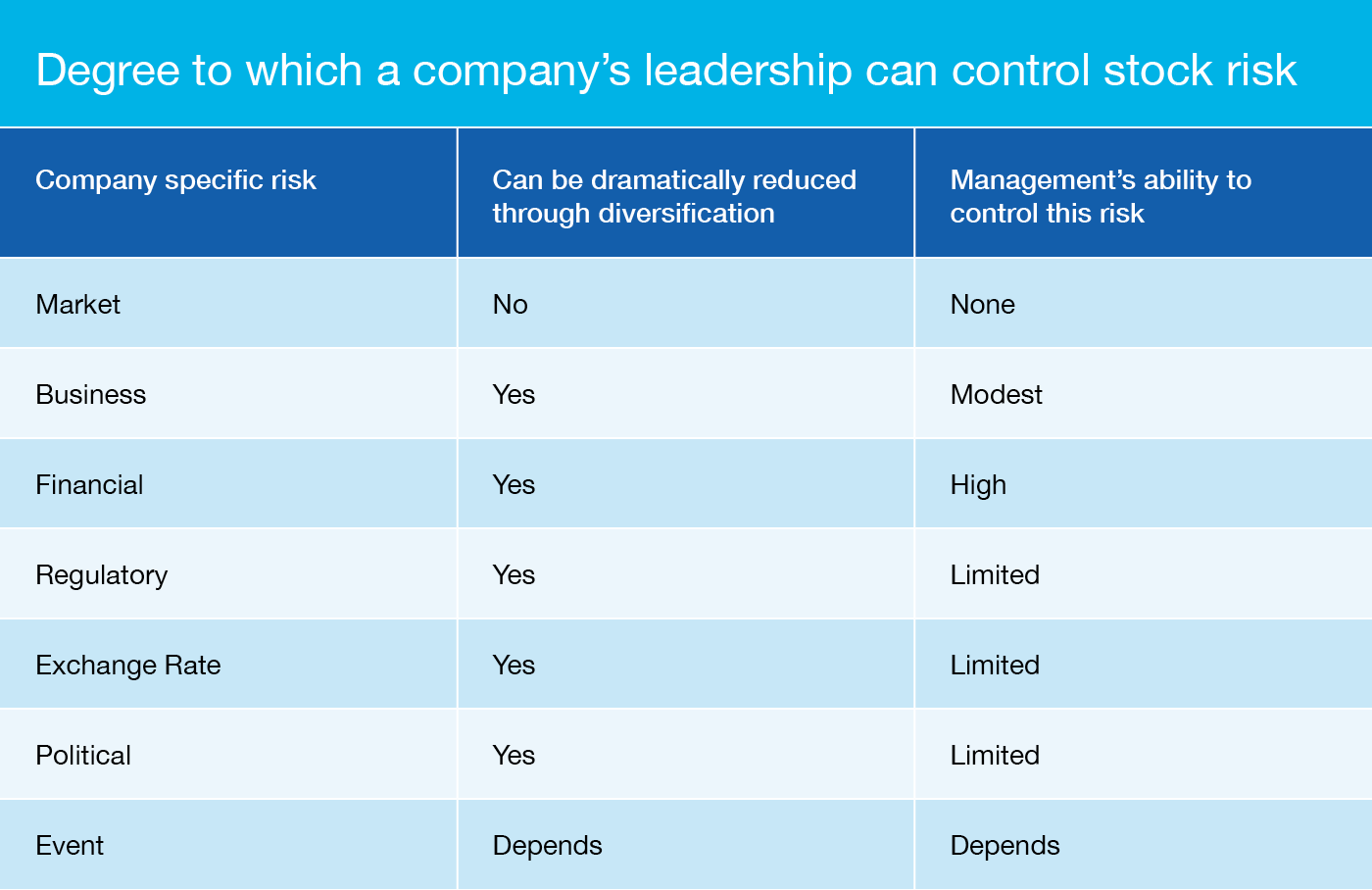

There are two categories of risks: market and company. Market risk can’t be eliminated through diversification—making them critically important to assess. But company risk can be reduced or eliminated through diversification. Adding stocks with unrelated or opposite drivers can achieve better balance.

The types of company-specific risks to consider include:

- Business risk, like fluctuations in earnings

- Financial risk, stemming from the company’s financial policies

- Regulatory risk

- Exchange rate risk

- Political risk

- Event risk, arising from unpredictable events

It’s important to understand that there’s a limit to the level of control that a company’s management has when it comes to risk. Leadership can’t control market fluctuations but it can control its own company’s financial policies, for example.

Whipped cream or wheatgrass: What are my options?

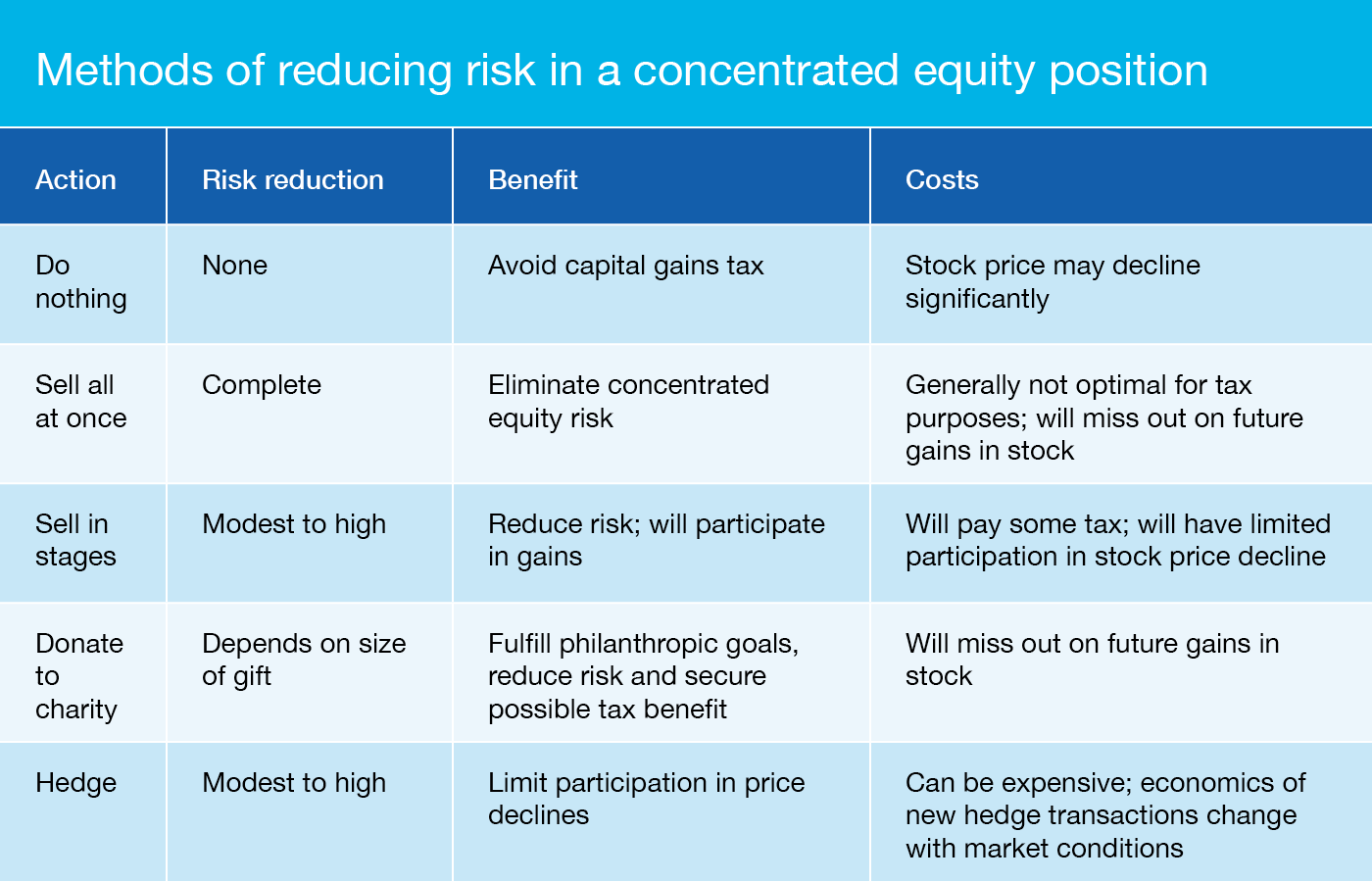

If you find yourself in a “too much of a good thing” situation where concentrated equity is concerned, there are several things you can do, depending on your financial goals and risk aversion. The following chart summarizes the benefits and costs of these five approaches to reducing risk when you own a concentrated stock position:

- Do nothing

- Sell all at once

- Sell in stages

- Donate to charity

- Hedge your position

Given the financial risk, extensive tax, regulatory and other considerations, it’s a good idea to have a trusted adviser at your side when considering how best to approach a concentrated equity position.

Learn more about how Badgley can help with that here. As for your whipped cream predicament, we’re at a loss.