by

Badgley Phelps

| Mar 21, 2017

By Tim Thomas

March 21, 2017

Stocks have moved higher since November’s election, in part due to the anticipation of corporate tax reform. Changes in the tax code could have a significant impact on earnings and some industry estimates indicate that reform, in the aggregate, may boost earnings by more than 5%. However, there will be winners and losers depending on the contents of the final tax bill. Presently, there are several proposals, but common elements include meaningful reductions in both the federal tax rate and the tax on cash repatriated from profits generated in foreign countries. Immediate deductions of capital expenditures are also under consideration.

While there are many proponents of corporate tax reform, there is also a strong voice within Congress calling for these changes to be revenue neutral. Our government debt is already at a high level and there is a sizeable contingent that wants tax reform with no increase in our debt burden. To pay for the tax cuts, current recommendations include a border tax adjustment and the elimination of certain deductions.

How will the tax cut affect company earnings?

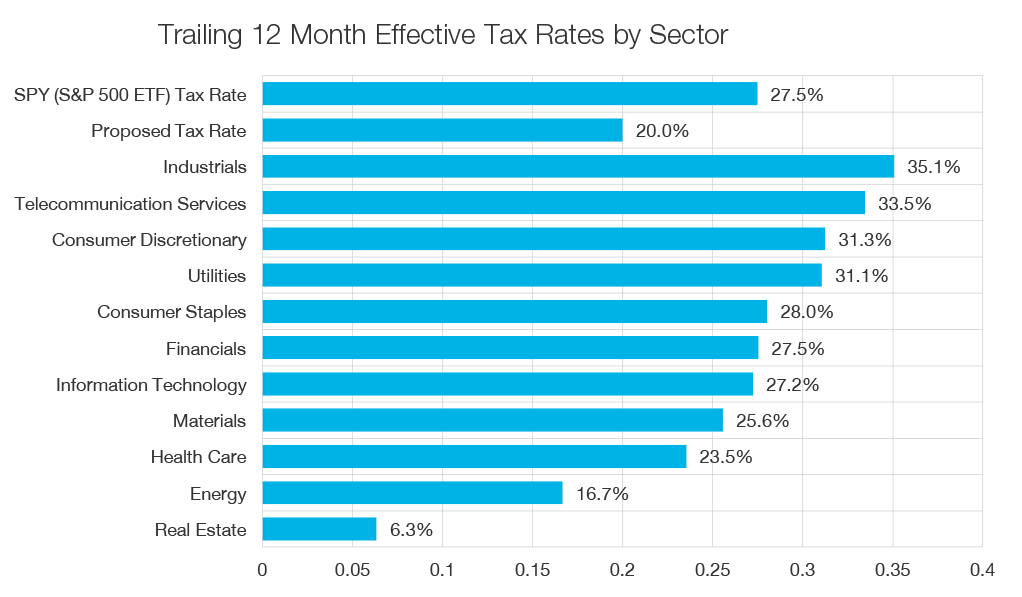

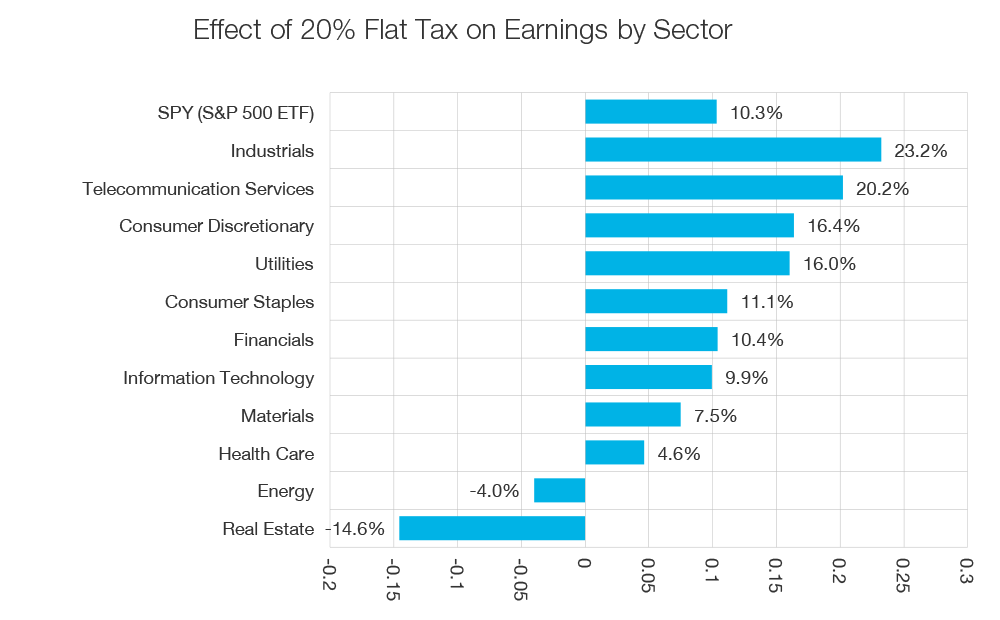

President Trump has called for a reduction in the corporate tax rate to 15%. However, House Republicans are currently moving forward with a plan to reduce it to 20%, which is more palatable to those who want to avoid a significant increase in the budget deficit. Both plans will generate a meaningful tax cut for many companies. We estimate that the weighted average effective tax rate for S&P 500 companies was approximately 27.5% over the last 4 quarters. A cut to 20%, without any other changes, will result in a 10% increase in earnings for the S&P 500 Index and will reduce the forward P/E of the S&P 500 from 18x to 16x.

Source: Bloomberg

Which companies will benefit most?

While the proposed tax cuts will lower overall taxes in aggregate, the benefits and costs of the proposed reforms will not be evenly distributed across sectors, industries and companies.

A reduction in the tax rate will provide the greatest benefit to sectors with the fewest exclusions, deductions and offsets. In other words, those companies with high effective tax rates will accrue a large portion of the savings. This group of companies includes those in the industrials, telecommunication and consumer discretionary sectors. In contrast, sectors such as real estate, energy and health care have low effective tax rates and will benefit the least. There is also a proposal to allow companies to immediately deduct their capital expenditures. An immediate deduction, as opposed to depreciating the cost over the life of the acquired asset, provides a tax incentive to invest a higher portion of current profits towards future growth. In doing so, companies will lower their tax payments to the government and increase after-tax profitability. This policy will likely accelerate company timelines for capital purchases in the coming years and may help to boost economic growth. Primary beneficiaries of this policy include capital intensive businesses such as domestic manufacturers.

Source: Bloomberg

Source: Bloomberg

There will also be an impact from the changes designed to make up for lost revenue from lower tax rates. Proposals include the implementation of a border adjustment tax, elimination of the deduction for interest expense and encouraging repatriation of foreign cash reserves by lowering tax rates. These revenue generators will play a major role in determining which sectors and industries benefit from corporate tax reform.

What sectors of the economy will be most affected by a border tax?

The proposed border adjustment tax will eliminate the tax deduction for imported goods and implement a tax deduction for exports. For companies with import costs that represent a significant amount of their expenses, the border tax will boost their tax bill and reduce their net income. Retailers and consumer goods companies will be especially hard hit, as many of these companies import a large portion of their inventory from abroad. Without any change in the value of the U.S. dollar, many consumer goods companies will see their taxes rise and will have to increase prices to maintain current profitability levels. Thus, critics have argued that a border adjustment tax will make many retailers uncompetitive while also boosting inflation as prices of consumer goods rise.

Advocates of the proposal argue that these negatives will be offset by a rise in the U.S. dollar and the tax deduction received on exports. Companies that export their products will receive a significant reduction in their tax expense and will be poised to use the savings to boost production as well as hire more American workers.

Given the potential impact on stakeholders, some Senate Republicans have said they are against the border adjustment tax. This will make it difficult for House Republicans to include the tax as a part of the reform and reduces the risk that a border adjustment tax will be implemented. If the border adjustment tax isn’t included in the tax bill and the emphasis on a revenue neutral plan remains intact, Congress will likely have to find another way to either make up for lost revenue, adopt a less significant tax cut, or some combination of these two solutions.

Will the elimination of interest deductibility change how companies allocate their capital?

The ability to deduct interest expense adds to the attractiveness of debt compared to equity, because income that flows to equity holders is taxed. Even without tax deductibility, debt carries a lower required return than equity due to the debt holder’s right to claim assets of a bankrupt company before equity owners. Because of this, debt will still have a place in company capital allocation; however, companies will likely reduce their leverage, on average, because it will be comparatively less attractive in the capital structure without a tax advantage. Companies with the highest tax rates and leverage stand to lose the most from this elimination, such as those in the telecommunications and utilities sectors.

What is likely to happen with overseas cash repatriations?

If companies are allowed to repatriate cash into the U.S. under favorable tax terms, they will likely use that cash to either make shareholder distributions or fund potential acquisitions. Capital expenditures will also be under consideration but they take longer to plan and implement than a simple stock repurchase. Companies can have a more immediate effect on their stock value by simply repurchasing shares. Regardless, cash repatriation provides a significant opportunity to return cash to shareholders or invest in profitable projects, which should help to boost stock prices.

Will changes to the corporate tax code impact my portfolio?

Changes in the corporate tax code are expected to lower corporate taxes overall, which should provide a boost to total company earnings and stock prices. However, under the current proposals there are likely to be winners and losers. Assuming all aspects under consideration are adopted, the impact on an individual stock will be dependent upon its tax rate, the degree to which they import basic materials and export finished goods, the extent of foreign sales, their capital structure and the capital intensiveness of the business. While it is still early in the process, we are looking for opportunities to take advantage of the changing tax code and have incorporated that in our analytical framework. As time passes and the final reform bill takes shape we will look to reposition, as necessary, for what could be a shifting economic landscape.