by

User Not Found

| Oct 10, 2018

By Tim Thomas, CFA

Last month, we reached the 10th anniversary of the Great Recession. In September 2008, Lehman Brothers collapsed, loan defaults were rising, and the economy was well entrenched in a deep recession. In response, the government introduced a $700 billion bailout program called the Troubled Asset Relief Program (TARP) and the Federal Reserve provided significant amounts of stimulus. Despite their efforts, corporate earnings fell significantly, and the S&P 500 Index suffered persistent declines until finally reaching bottom in March 2009.

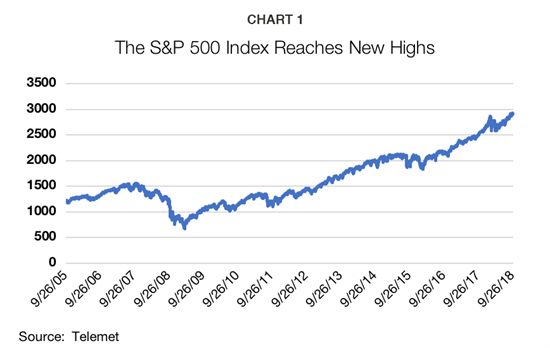

Those were difficult times, but things have improved significantly in the last ten years. Since then, the S&P 500 Index has increased dramatically, generating a total return of more than 400 percent (see chart 1). Notably, the index reached a record high last month, but thanks to strong earnings growth, the valuation on the stock market remains just a little above its long-term average at 17x forward earnings.

The economic recovery and the dramatic rise in asset prices since that time are reflective of changes in the landscape that have unfolded over the last ten years. These developments are important as they shaped the recovery from the Great Recession and are likely to have an impact on the course of the economy and financial markets in the next decade. In the following discussion, we describe some of these factors and discuss their expected progression in the coming years.

Consumers and banks reduce debt while the U.S. government ramps up borrowing

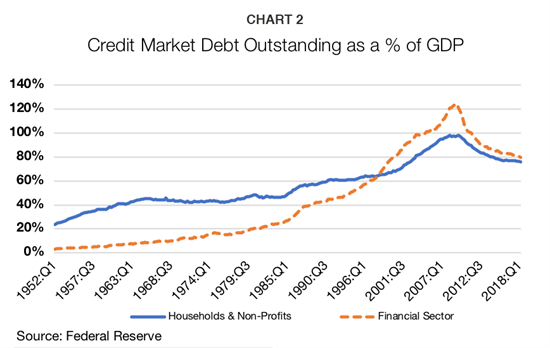

New regulations were enacted shortly after the crisis which required banks to reduce their debt and maintain much higher levels of capital. They also outlawed many of the banks’ speculative activities that helped fuel the 2008 debt bubble. At the same time, consumers have become much more responsible and have limited their outstanding debts. It’s hard to believe, but outstanding mortgage liabilities are lower today than they were in September of 2008. As a result, total consumer debt, as a percentage of our country’s GDP, has declined significantly from its 2008 peak (see chart 2).

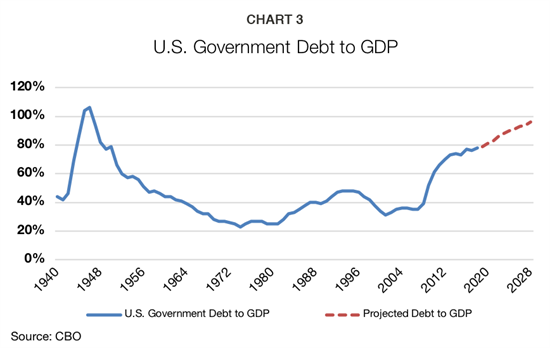

In contrast, U.S. government debt increased significantly over the last ten years. The U.S. government provided massive stimulus in the form of debt-financed spending to cushion the deflationary impact of consumer and bank deleveraging. At the end of 2007, U.S. government debt totaled 35 percent of our GDP, but by 2012, the debt level had ballooned to 70 percent. Since that time, government borrowing has steadily increased and the Congressional Budget Office (CBO) projects that we will end 2018 at the highest level since the end of World War II.

Looking forward, The Congressional Budget Office forecasts that government debt levels will continue to rise given our aging population and increasing demands on our entitlement programs. They also believe that rising interest costs will be a significant factor. Accordingly, the CBO estimates that U.S. government debt relative to GDP will continue to increase and will be close to 100 percent by the end of 2028 (see chart 3).

Aggressive stimulus programs and historically low interest rates

As the economic crisis developed, the Federal Reserve responded by lowering interest rates to zero, boosting the size of their balance sheet to $4.5 trillion and developing programs that helped facilitate borrowing in those areas of the credit markets that were troubled. Banks in Europe and Japan also followed suit with similar programs, many of which continue to this day. Accordingly, interest rates reached historical lows and today they remain well below their long-term averages.

In the coming years, it is likely that nontraditional monetary policies will become a prominent feature once again. Despite the improvement in the global economy, the aggressive strategies of the last ten years are still being employed, particularly in Europe and Japan. Until the global economy can recover to such a degree that these programs are unwound, and interest rates return to more normal levels, traditional policy responses may not be sufficient to reverse the negative trends when the next recession begins.

Corporate tax reform creates positive structural change

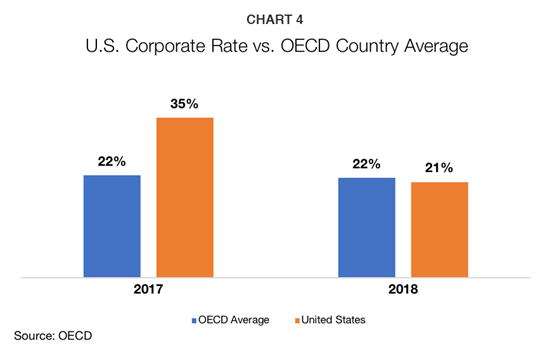

There are positive forces at work as well, including the recently enacted tax reform which generated a fundamental change in the landscape. In the short term it is serving as a stimulative boost to the economy and is partially responsible for this year’s strong earnings growth. However, there are also significant long-term benefits in that it makes our tax code more competitive on a global scale and significantly reduces the incentive for companies to engage in tax avoidance strategies or move overseas (see chart 4).

The tax reform also removes the incentive to keep offshore those profits generated in foreign markets. Until this year, much of the profits generated overseas were kept in foreign countries to avoid taxation in the U.S. Going forward, that cash can be brought back to the U.S. and used in a way that maximizes shareholder value. In short, under the new tax structure, we expect many of the tax avoidance strategies of the last decade to be a thing of the past and a heightened focus on the most efficient uses of capital, regardless of whether that is reinvestment in the business, higher dividends, share buybacks or a combination of the three.

A technology renaissance

We have also experienced a technology renaissance given a rare confluence of events which includes the proliferation of high-powered smartphones, the development of extensive computer networks, the advancement of artificial intelligence and the advent of cloud computing. Networks connect people or devices, allow for sharing of information and facilitate the collection of huge amounts of data. Cloud computing, or “the cloud,” serves as a critical component of today’s networks, as well as a storage hub for the vast ocean of data the networks provide. Artificial intelligence facilitates complex analyses that turn the raw data into information. Perhaps most important, the networks and data can be accessed from anywhere via your phone.

The forces driving these technology trends are strong and will continue for years to come. In the past, the technology revolution has been focused on industries such as music, books and other goods which are digital and therefore can be duplicated at virtually no cost then delivered to buyers instantly across the internet. However, in the coming years we expect these trends to continue advancing to service businesses. We are seeing examples of this today with the dramatic rise of ridesharing services such as Uber, meal delivery services and in-home fitness offerings such as those provided by Peloton.

This process will create opportunities for new companies and threats to the incumbents. Consumers should benefit in the form of lower prices for goods and services as the economics of these businesses tend to favor a lower margin/high volume approach. Of course, opportunities will also be generated for active investors as the creative destruction process forms the next generation of winners and losers. While advancements in technology and equity returns in that sector tend to be cyclical we are excited about the long-term prospects as the trends discussed above are still in the early stages of development.

Putting it all together

The last ten years have been momentous. In 2008, it would have been nearly impossible to imagine the world as it exists today. Having said that, it is almost certain that we will have a similar circumstance when we look back ten years from now. Clearly there are reasons for optimism and some sources of concern, but we look forward to the coming decade.