by

User Not Found

| Jan 04, 2023

Congress passed the Consolidated Appropriations Act of 2023 right before funding for the federal government was set to expire on December 23, 2022. This bill authorizes $1.7 trillion of omnibus government spending.

Included in the Consolidated Appropriations Act of 2023 is Secure Act 2.0, which includes a host of provisions intended to strengthen the retirement system and boost retirement savings. Several key takeaways from this legislation are detailed below.

Required Minimum Distributions

The age for Required Minimum Distributions (RMD) will increase to 73 in 2023. In 2033, the RMD age will increase even further to 75. This is a benefit to retirees who have adequate savings outside of retirement accounts or receive healthy pensions as it provides additional runway for managing taxable distributions from IRAs.

The penalty for missing an RMD will be reduced to 25% instead of 50%. If the missed RMD is corrected by the end of the second year following the year it is due, this penalty will drop to 10%.

Retirement catch-up contributions

Starting in 2025, individuals between the ages of 60 and 63 can make a catch-up contribution of the greater of either $10,000 or 150% more than the regular catch-up contribution (currently $7,500).

For people with income above $145,000 (indexed for inflation), any catch-up contribution must be made to a Roth account with after-tax dollars. For clients who have saved and invested well for retirement, this provision reinforces the idea to have different buckets, both taxable and tax-free, to distribute from in retirement. Managing the tax impact with each year’s distribution provides the opportunity for lower cumulative tax cost.

IRAs currently have a $1,000 flat catch-up contribution for people aged 50 or older. Starting in 2024, the catch-up contribution will be indexed to inflation, so it will increase yearly to keep up with the cost-of-living adjustments.

Qualified Charitable Distributions

Currently, retirees over 70 ½ have a powerful tool to make Qualified Charitable Distributions (QCD) from retirement accounts up to $100,000. Previously, these gifts had to be made directly to the charity from an Individual Retirement Account. Secure Act 2.0 expands QCDs to allow a one-time gift of $50,000 to a charitable trust or gift annuity. Beginning in 2023, QCDs will also be adjusted for inflation.

Excess 529 funds

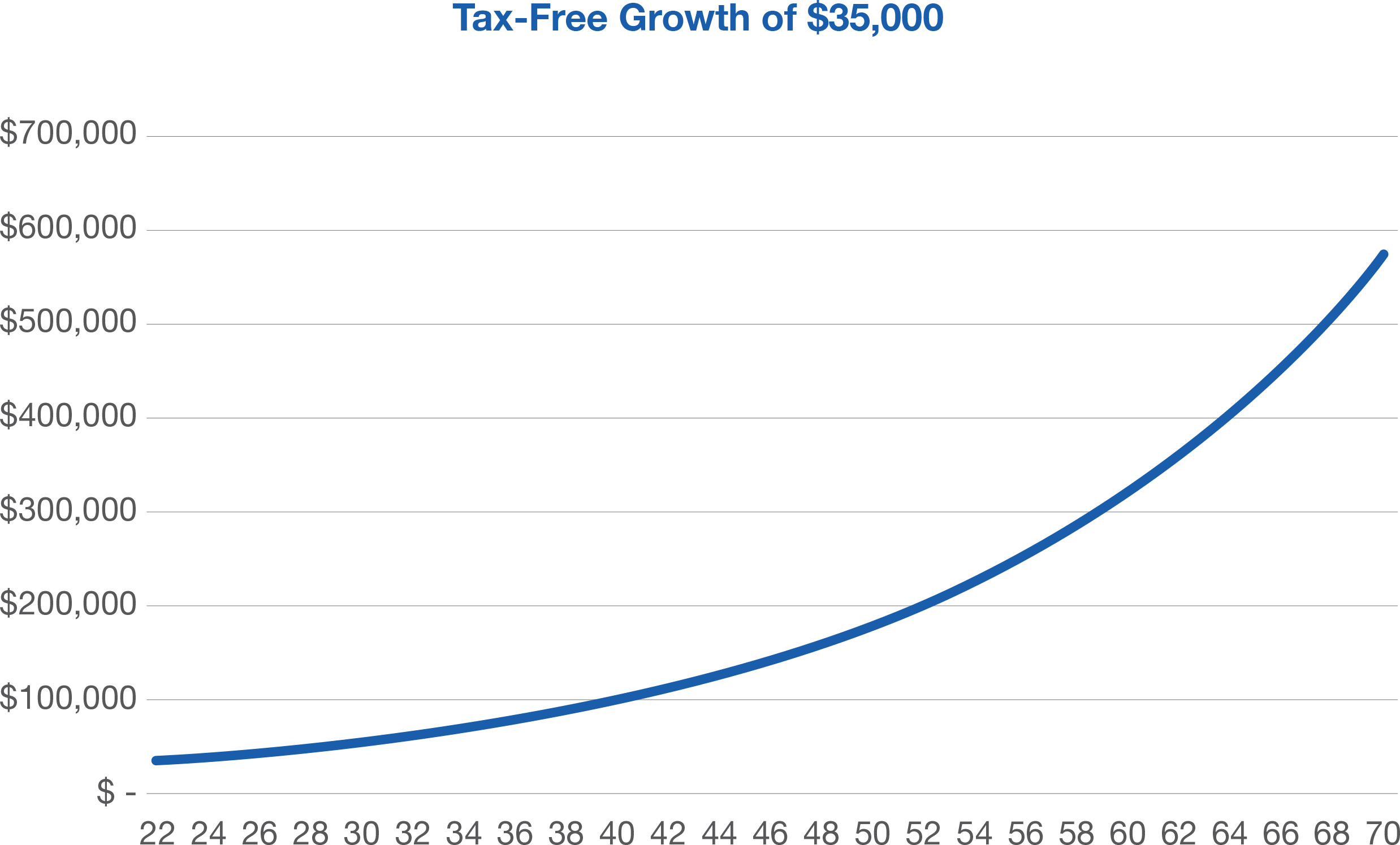

For people with surplus college savings, the legislation will allow tax- and penalty-free rollovers from 529 plans to Roth IRAs starting in 2024. These will be subject to Roth annual contribution limits and a lifetime contribution limit of $35,000. In addition, the 529 plan must have been open for over 15 years, along with other limitations. With the limitations and amount capped, this may not provide significant changes. However, for people with leftover 529 money, this change provides an additional option for transferring funds without tax implications. Rollovers are limited to the beneficiary of the 529 plan only, not the account owner.

While the amount to rollover to a Roth IRA is nominal, the ability to seed a Roth IRA for a young beneficiary will be very impactful over the life of their working and retirement years. The table below shows the growth of $35,000 assuming 6% average annual returns between ages 22 and 70.

Roth retirement savings

Employees can elect employer matching contributions to a Roth account vs. pre-tax account effective immediately. However, it may take your plan administrator some time to adjust the proposed changes.

Also, until now, only Roth IRAs have been exempt from the Required Minimum Distribution (RMD). Secure Act 2.0 will exempt the Roth component of 401(k) plans from mandatory Required Minimum Distributions starting in 2024 to line up with traditional 401(k)s. Beginning in 2023, you can make Roth contributions to SIMPLE and SEP IRAs.

Just when you think the government creates more barriers, Secure Act 2.0 will create a national lost and found online database for forgotten retirement accounts within two years of enactment. Once in a while, they can create something that can be very helpful!

We will continue monitoring and evaluating legislative changes and share additional insights when appropriate. Our financial planning team is always here to help. Contact us today.