by

User Not Found

| Sep 03, 2024

It is likely you, your friends, and family have all experienced increased premiums on your property and casualty insurance policies in recent years. These increases have left many wondering about the reason behind the surge in prices, whether rising premiums may continue, and what other options might be available. We have examined the issues and trends surrounding the most common property and casualty insurance policies in order to help you apply them to your own personal insurance situation.

Auto insurance premium increases

Auto insurance premiums have skyrocketed in recent years. According to Bankrate, premiums for full coverage have already increased by 26% in 2024. The reasons why are multifaceted. First and foremost, there are more drivers on the road today than ever before, consisting largely of both the country’s aging population and young drivers. People are also still less inclined to take public transportation with the uncertainty around COVID-19, leading to an increased number of individuals behind the wheel.

More drivers mean more accidents and consequently a greater number of insurance claims. The claims are also higher than ever as costs of new vehicles, labor, and parts are all increasing. As a result, insurance companies are forced to raise the cost of your insurance.

While we recommend this as a discussion with your insurance agent, one way in which you can offset rising premiums is to balance them with a reasonable deductible. It is worth reviewing your policies with an eye towards your risk level and at what level you would be comfortable self-insuring. By aligning your ability to self-insure with your level of comfort, you could potentially save money on your premiums and offset rising costs.

Homeowners insurance increases

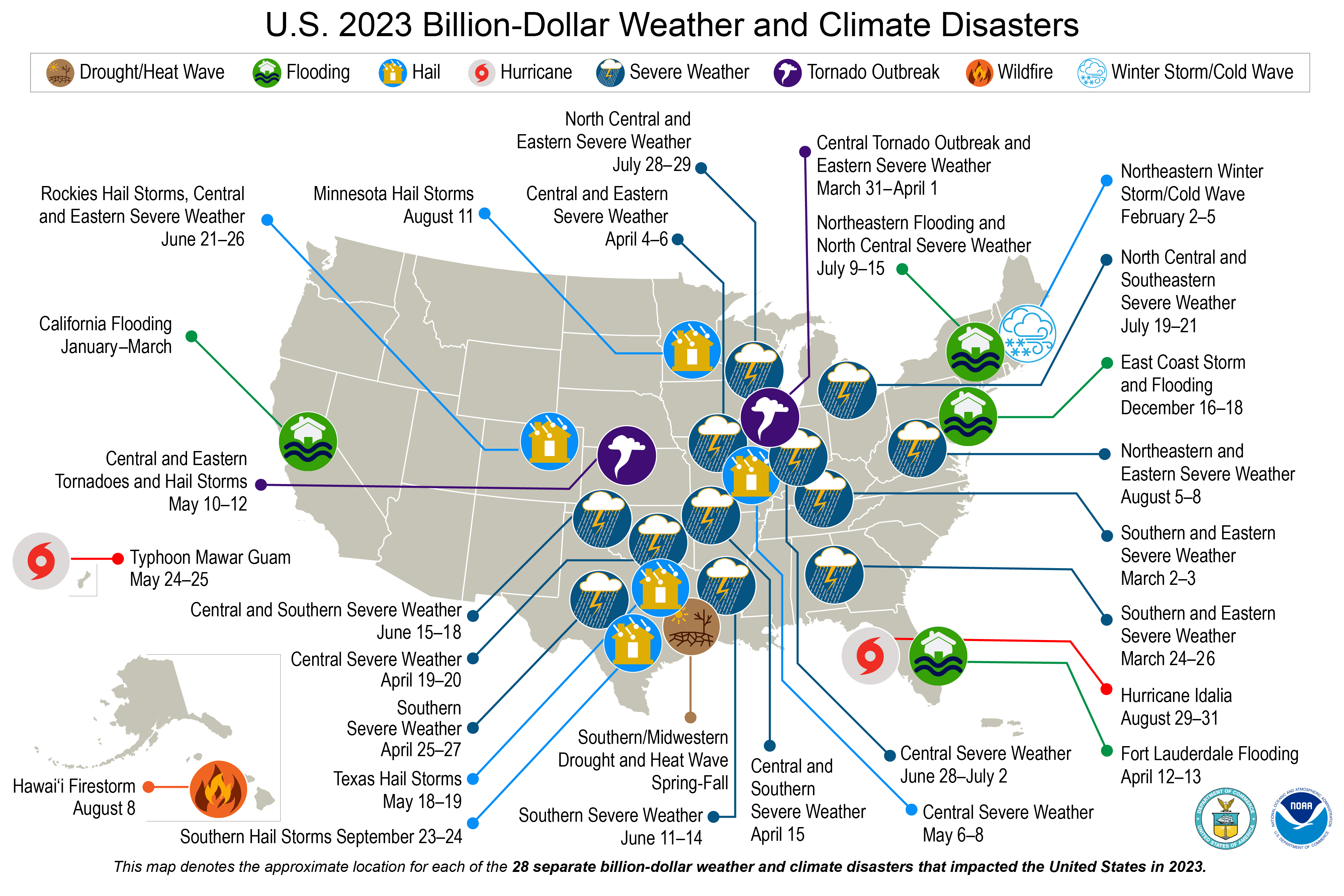

Homeowners insurance has also been on the rise. One reason can be attributed to the high material costs for new construction and repairs. Another reason stems from the number of people residing in areas susceptible to natural disasters. States such as California, Texas, and Florida are at risk of natural disasters such as hurricanes and wildfires, which has led to a greater number of claims. While many storms are concentrated in these states, billion-dollar weather disasters are occurring across the United States. The chart below from climate.gov illustrates these claims in 2023 alone.

Source: Climate.gov

In recent years, we have seen insurers drop coverage, let policies lapse, and even pull out of servicing certain areas prone to these disasters. The largest, most well-known carriers exiting the market in certain areas include State Farm, Allstate, Farmers Insurance, and American National. These are just a handful of companies that are reconsidering where they will provide coverage, and we expect insurers to only continue to increase premium costs and desist coverage in natural-disaster prone areas.

Despite the rising costs and issues surrounding the homeowners insurance market, it is important to maintain adequate coverage at all times. We often see dwelling coverage that is no longer adequate to rebuild due to rising costs of materials and lack of regular policy review. Your insurance agent should be able to inform you about recommended coverage in your service area.

Those who live in areas prone to natural disasters are accustomed to the struggle of securing insurance. We have seen the uprise of the Fair Access to Insurance Requirements Plans, also referred to as “FAIR Plans.” According to the Insurance Information Institute in 2023, 33 states had active FAIR Plans for their residents. Backed by each state’s private insurance market, FAIR Plans are used as a last resort for those who are unable to retain or secure homeowners’ coverage in disaster prone areas. The qualifications to participate vary by state, but usually include home types, building requirements, the amount of time that the residence is occupied, and proof of previous denial for insurance in the private market. These policies also vary in coverage amounts and types depending upon the states plan. Additional endorsements may be available for an added cost. While these programs may be an option for some homeowners, certain state’s FAIR Plans have faced legal challenges and should be carefully considered.

Earthquake insurance increases

If you live in an earthquake prone area, earthquake insurance could be a necessity. As with other types of insurance, the costs of these policies are on the rise. Depending upon where you reside or own property, coverage is necessary if your homeowners insurance provides little to no coverage if your home is impacted by an earthquake because this policy covers your dwelling, personal belongings, and living expenses if you can’t return to your home. Coverage costs thousands of dollars a year and is directly correlated with your proximity to fault lines. Securing and retaining this coverage can be difficult but can commonly be added to your homeowners policy or a separate policy may be issued. Some states, specifically California, have programs that assist families with securing earthquake insurance relative to their needs.

Umbrella coverage is imperative

Umbrella insurance covers liability shortfalls after your underlying home or auto policies limits have been exceeded. In the world we live in today, having umbrella coverage commensurate with your net worth, up to $10 million, is imperative. Beyond this threshold, we recommend a more measured risk conversation with your insurance agent. While umbrella insurance remains inexpensive relative to the amount of coverage it may provide, we have seen costs rise more recently. According to Safeco, insurance claims doubled between the years 2010 and 2020. These increases can also be linked to higher costs and a rising number of claims. Despite the rising cost to insure, we deem umbrella insurance a necessary insurance coverage to protect yourself, family, and your assets.

Conclusion

We recommend staying on top of your insurance coverage and doing a thorough review of your policies at least every 3 years if there have been no material changes. Take note of increasing deductibles, premiums, and potential lapses in any of your insurance coverages. It may also behoove you to shop around insurance providers to find the most competitive, thorough coverage available.

One consideration to make is if you may qualify for insurance through a high-net-worth insurance company. Some of these carriers include names you might recognize such as PURE, Chubb, AIG, Vault, and Cincinnati Insurance. These companies provide insurance offerings based on home value or net worth. This opens you up to a group offering higher limits and liability as well as guaranteed replacement coverage. If you are curious about your options, a member of our financial planning team at Badgley Phelps would be happy to meet with you and explore the best solution.

Originally posted August 28, 2024