by

User Not Found

| Sep 28, 2017

By Tim Thomas

September 28, 2017

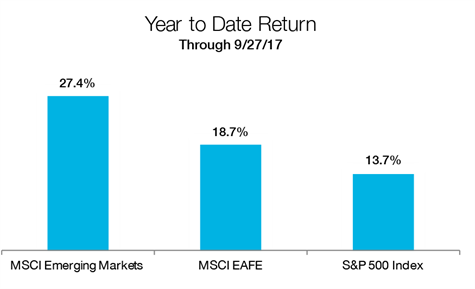

For the first year since 2012, we are enjoying a stock market rally worldwide. Stocks in developing economies have been the leaders in the group with the MSCI Emerging Markets Index up more than 27 percent year to date. There have also been solid gains for the S&P 500 Index in the U.S. and for the MSCI EAFE Index, which represents developed markets in Europe, Japan and Australia (see chart below).

But will the rally continue? And what does it all mean for the global equity markets?

The current climate

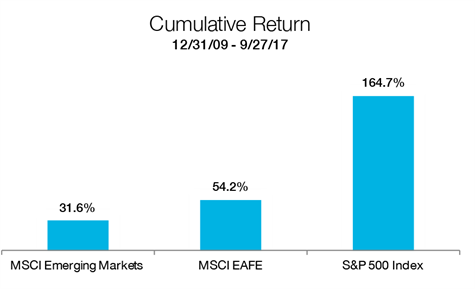

Since the end of the credit crisis in 2009, the world’s economies have experienced an uneven recovery. This resulted in disparate performance across global equity markets (see chart below).

However, this year we are seeing a synchronized economic expansion. In Europe, the economy grew 2.1% last quarter and interest rates have increased in many countries after falling to negative levels in the last couple of years. In Japan, the recovery is not as robust, but they have made progress and the economy is showing signs of improvement. The emerging markets have been particularly strong with expectations for a solid rebound from the persistent decline in their growth rate that started in 2011. In the U.S. we continue to enjoy modest but sustained growth, low interest rates and an improving employment market.

What is driving the recovery?

Despite the improvement in the global economy since the 2008 credit crisis, many of the central bank’s crisis-based monetary policies remain in place and the global level of stimulus is exceptionally high. For example, the European Central Bank currently maintains a policy rate of zero and has a quantitative easing program that results in the purchase of €60 billion worth of bonds every month. This program is expected to continue into next year, albeit at a reduced pace, which means that the level of monetary stimulus is likely to remain high in Europe for quite some time.

The Bank of Japan has been even more aggressive with direct intervention into the country’s equity markets. In addition to setting a target rate of zero for their ten-year government bond and supporting fixed income markets with the purchase of hundreds of billions of dollars of government debt, the central bank is also buying more than $50 billion equity ETFs each year. Bloomberg estimated that the result of this policy is that the Bank of Japan owned about 71 percent of the shares of all Japan-listed ETFs as of June 30 of this year (source: Bloomberg). In the U.S., the Federal Reserve has been reducing the level of stimulus and recently announced its intention to begin shrinking its balance sheet, but its stance remains accommodative with a target rate of just 1.00 to 1.25 percent.

The efforts of the central banks have begun to bear fruit and there is evidence of a sustainable global expansion. For example, consumer loan growth, manufacturing activity and commodity prices are on the rise, providing a signal that global demand for goods and services is increasing. In fact, according to Federal Reserve data, consumer loan growth in the U.S. has been steadily accelerating since the fourth quarter of 2015. Also, prices for commodities are rising, in part due to stronger than expected demand. Industrial metals have been particularly strong with copper rising nearly 20 percent year to date and oil prices up a similar amount from their lows just three months ago.

What does this all mean?

For equity markets, the improving global economy is allowing synchronized earnings growth worldwide. This is critically important as stocks generally follow the path of earnings, which explains the strength of the global equity markets this year. In the U.S., profits are on track to increase approximately 10 percent in 2017. The rest of the world is also participating in this expansion and we expect profit growth to be even higher for foreign stocks. In fact, international equities are particularly attractive as their earnings have been somewhat depressed since the end of the credit crisis and remain well below the pre-2009 peak. If the economic expansion continues, profits can increase meaningfully as they move toward, and possibly exceed, prior peak levels.

What are the risks?

The geopolitical climate and the reduction of monetary stimulus in the U.S. are two primary sources of risk. Geopolitical risks are clearly rising as tensions between the U.S. and North Korea increase. In the U.S., the Federal Reserve continues to reduce the level of monetary stimulus. Although the stimulus remains exceptionally high, they are intent on moving away from the crisis-based policies of the 2008-2009 era. If the Federal Reserve tightens its policy too quickly, the rate of economic growth may decline and the disinflationary pressures in the economy may, once again, become pervasive.

Valuations are also often cited as a risk, but we do not see this as a key driver of a market correction when viewed in isolation. Historically, market declines are only driven by valuation when metrics, such as the price to earnings multiple, reach extremes. In the aggregate, stocks around the world are generally trading close to, or a modestly above, their long-term average multiples. Furthermore, today’s low interest rate environment supports higher valuations as the low rates represent a small opportunity cost for receiving cash in the future. While they represent a relatively low risk as a driver of a correction, current multiples are high enough to suggest that returns going forward are increasingly dependent upon earnings growth.

Where do we go from here?

Improving economic conditions worldwide have resulted in a synchronized increase in earnings and equity markets are responding with strong gains. Given the lack of low valuations, we believe that earnings growth will drive future returns and we will be monitoring developments in that arena closely. At this juncture, the outlook remains favorable given the increasing strength of the global economy and exceptionally easy monetary policy worldwide. However, from 2010 through 2016 there was only one year in which the U.S. market did not experience a correction of 10 percent or more. We would not be surprised to see a correction in the coming year given the sheer strength of the market since the beginning of 2016, and the likelihood of one of the above-mentioned risks becoming a more elevated threat. While the level of volatility may increase in the coming months, there are few signs of recession on the horizon and the modest global growth in recent years has paved the way for a long economic expansion.